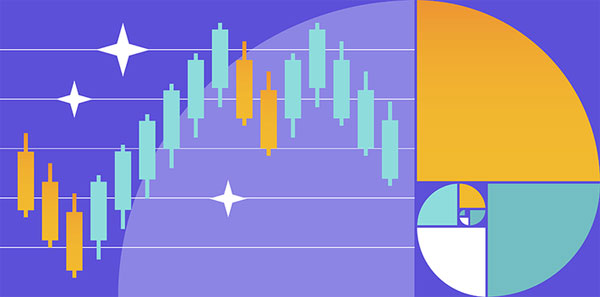

Fibonacci tools are a popular and powerful technical analysis tool used by traders to identify potential price reversal levels, extensions, and trends in the financial markets. Named after the Italian mathematician Leonardo of Pisa, also known as Fibonacci, these tools are based on the Fibonacci sequence and ratios, which have been proven to be reliable indicators in trading. In this article, we will explore different Fibonacci tools that traders can utilize to enhance their trading strategies.

The Role of Fibonacci Tools in Trading

Fibonacci tools play a crucial role in identifying potential support and resistance levels in trading. These tools are based on ratios derived from the Fibonacci sequence, such as 23.6%, 38.2%, 50%, 61.8%, and 100%. Traders use these levels to predict possible price retracements, extensions, and trends in the market. By applying Fibonacci tools to historical price data, traders can anticipate potential price movements and make more informed trading decisions.

Understanding Fibonacci Retracement Levels

Fibonacci retracement levels are used to identify potential support and resistance levels in a market. Traders typically draw Fibonacci retracement levels from a swing low to a swing high or vice versa to identify key price levels where a retracement may occur. The most commonly used Fibonacci retracement levels are 38.2%, 50%, and 61.8%. These levels can act as potential entry points for traders looking to capitalize on a market’s retracement.

How to Use Fibonacci Extensions in Trading

Fibonacci extensions are used to identify potential price targets in a market. By drawing Fibonacci extension levels from a swing low to a swing high or vice versa, traders can project possible future price extensions. The most commonly used Fibonacci extension levels are 127.2%, 161.8%, and 261.8%. These levels can help traders set profit targets and manage their trades effectively by anticipating potential price movements beyond the typical retracement levels.

Fibonacci Fans: A Powerful Trading Tool

Fibonacci fans are a set of diagonal lines based on the Fibonacci sequence that traders use to identify potential support and resistance levels in a market. By drawing Fibonacci fan lines from a significant low to a significant high or vice versa, traders can visualize potential trend lines and price movements. Fibonacci fans are particularly useful in trend trading, as they can help traders identify key levels where a trend may reverse or continue.

Leveraging Fibonacci Time Zones in Trading

Fibonacci time zones are based on the Fibonacci sequence and ratios, which traders can use to identify potential reversal points in time. By dividing a significant price move into different time zones based on Fibonacci ratios, traders can anticipate key time periods where a market may reverse or continue its trend. Fibonacci time zones are a valuable tool for traders looking to incorporate time analysis into their trading strategies.

Best Practices for Incorporating Fibonacci Tools in Trading

When incorporating Fibonacci tools into your trading strategy, it is essential to follow best practices to maximize their effectiveness. Some key tips for using Fibonacci tools in trading include:

- Identify significant swing points to draw Fibonacci retracement and extension levels accurately.

- Use Fibonacci tools in conjunction with other technical indicators to confirm potential price levels.

- Regularly update and adjust Fibonacci levels as the market evolves to stay on top of changing price dynamics.

Comparison Table: Fibonacci Tools in Trading

| Tool | Purpose | Usage |

|---|---|---|

| Retracement Levels | Identify support and resistance levels in a market | Draw levels from swing highs and lows |

| Extensions | Project potential price targets in a market | Draw levels to set profit targets |

| Fans | Visualize potential trend lines and price movements | Draw fan lines to identify key levels |

In conclusion, Fibonacci tools are valuable resources for traders seeking to enhance their technical analysis and make more informed trading decisions. By understanding and utilizing Fibonacci retracement levels, extensions, fans, and time zones, traders can identify key price levels, projections, and time periods in the market. By following best practices and incorporating Fibonacci tools effectively into their trading strategies, traders can gain a competitive edge and improve their overall trading performance.