Elliott Wave Theory is a popular method used by traders to analyze market cycles and predict future price movements. This theory is based on the idea that markets move in repetitive patterns, which can be identified and used to make profitable trading decisions in the forex market. By understanding the basics of Elliott Wave Theory and applying its principles, traders can enhance their trading strategies and improve their chances of success in the forex market.

Understanding the Basics of Elliott Wave Theory

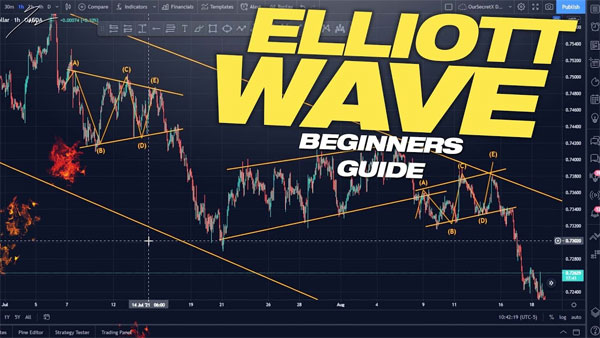

Elliott Wave Theory was developed by Ralph Nelson Elliott in the 1930s and is based on the principle that markets move in repetitive patterns that can be divided into “waves.” These waves can be classified into two categories: impulse waves and corrective waves. Impulse waves move in the direction of the primary trend, while corrective waves move against the primary trend. By identifying these waves and understanding their characteristics, traders can anticipate future market movements and make informed trading decisions.

Analyzing Forex Market Trends with Elliott Waves

In the forex market, trends are constantly changing, making it challenging for traders to predict future price movements. However, by using Elliott Wave Theory, traders can analyze market trends and identify potential trading opportunities. By studying wave patterns and observing how price movements develop, traders can gain valuable insights into market trends and make more accurate forecasts. This can help traders capitalize on profitable trading opportunities and minimize potential risks.

Applying Elliott Wave Principle in Forex Trading

When applying Elliott Wave Theory in forex trading, traders typically use a combination of technical analysis tools and market indicators to identify wave patterns and validate their trading decisions. By using Fibonacci retracement levels, moving averages, and other technical indicators, traders can confirm wave patterns and make more informed trading decisions. Additionally, traders can use Elliott Wave counts to determine price targets and set stop-loss orders to manage risk effectively.

Identifying Trading Opportunities with Elliott Waves

One of the key benefits of using Elliott Wave Theory in forex trading is the ability to identify potential trading opportunities before they happen. By analyzing wave patterns and understanding market trends, traders can anticipate price movements and enter trades at strategic levels. This can help traders maximize their profits and minimize potential losses by taking advantage of emerging trends and market reversals.

Common Mistakes to Avoid when Using Elliott Wave Theory

While Elliott Wave Theory can be a powerful tool for forecasting market trends, there are several common mistakes that traders should avoid when using this method. Some of these mistakes include:

- Misinterpreting wave patterns and making incorrect trading decisions

- Overcomplicating the analysis and losing focus on key wave patterns

- Failing to use additional technical indicators to validate wave counts and confirm trading signals

By being aware of these common mistakes and taking steps to avoid them, traders can improve their accuracy in using Elliott Wave Theory and enhance their trading performance in the forex market.

Enhancing Forex Trading Strategies with Elliott Waves

By incorporating Elliott Wave Theory into their forex trading strategies, traders can gain a deeper understanding of market trends and make more informed trading decisions. This can help traders identify potential trading opportunities, set realistic price targets, and manage risk effectively. By combining Elliott Wave analysis with other technical indicators and market tools, traders can develop a comprehensive trading strategy that maximizes their profits and minimizes potential losses. Overall, Elliott Wave Theory can be a valuable tool for traders looking to improve their trading performance in the forex market.

| Aspect | Elliott Wave Theory | Traditional Technical Analysis |

|---|---|---|

| Methodology | Based on wave patterns | Uses past price data and indicators |

| Predictive ability | Identifies market cycles and trends | Predicts price movements based on indicators |

| Complexity | Requires understanding of wave patterns | Relies on mathematical calculations and indicators |

| Risk management | Can help identify potential reversals and set stop-loss orders | Relies on risk-reward ratios and technical indicators |

| Market timing | Can help anticipate market trends in advance | Focuses on identifying entry and exit points |