The world of trading has expanded significantly with the advent of the internet, and two of the most popular markets for traders today are Forex and Crypto. Both markets offer the potential for significant returns, but they also come with their own set of risks and challenges. In this article, we’ll explore the differences between Forex and Crypto trading, how to get started, strategies for success, and more.

Forex vs Crypto: What’s the Difference?

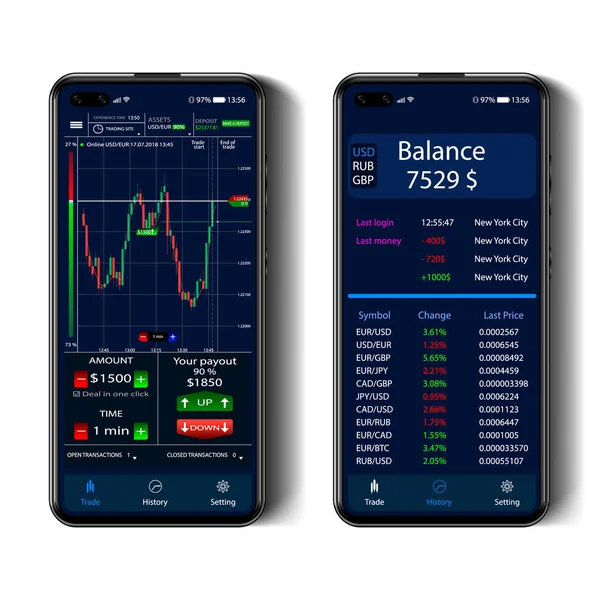

Forex, or foreign exchange, trading involves the buying and selling of currencies in pairs. It is the largest financial market in the world, with a daily trading volume of over $6 trillion. The market operates 24 hours a day, five days a week, and is highly liquid.

Crypto trading, on the other hand, involves the buying and selling of cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. The market is relatively new, having only been around for little over a decade, and is known for its high volatility and 24/7 trading.

Comparison Table:

| Forex | Crypto |

|---|---|

| Operates 24/5 | Operates 24/7 |

| Highly liquid | High volatility |

| Regulated | Less regulated |

Understanding Forex Trading Basics

Forex trading involves buying one currency while simultaneously selling another. Currency pairs are categorized into three groups: majors, minors, and exotics. Majors are the most traded and include pairs like EUR/USD and USD/JPY, while minors and exotics are less commonly traded.

When trading Forex, it’s important to understand the concept of leverage, which allows traders to control a larger position with a smaller amount of money. However, leverage also increases the risk of losses.

Traders also need to be aware of the factors that influence currency values, such as economic indicators, political stability, and central bank policy.

The Rise of Cryptocurrency Trading

Cryptocurrency trading has exploded in popularity in recent years, thanks in part to the meteoric rise of Bitcoin. Cryptocurrencies are decentralized digital assets that use blockchain technology to facilitate secure transactions.

Unlike Forex, the crypto market is not regulated by any central authority, making it a more accessible but riskier market.

The volatility of the cryptocurrency market can lead to significant gains, but it also means that traders must be prepared for the possibility of sudden and dramatic price movements.

How to Get Started in Forex Trading

Getting started in Forex trading is relatively straightforward. Here are the steps to follow:

- Choose a reputable Forex broker and open a trading account.

- Fund your account and familiarize yourself with the trading platform.

- Develop a trading plan and practice with a demo account before trading with real money.

It’s also important to continuously educate yourself about the Forex market and to stay up to date on economic news and events that can impact currency values.

Strategies for Successful Crypto Trading

Here are some strategies that can increase the chances of success in crypto trading:

- Do thorough research on the cryptocurrencies you plan to trade, including their use cases, technology, and team behind the project.

- Use technical analysis to identify trends and make informed trading decisions.

- Have a risk management plan in place, including setting stop-loss orders to limit potential losses.

Navigating the Risks of Forex and Crypto

Both Forex and Crypto trading come with their own set of risks. The high leverage in Forex can lead to substantial losses, while the unregulated nature of the crypto market can make it susceptible to fraud and hacking.

It’s crucial for traders to have a solid risk management plan in place, which includes setting stop-loss orders, diversifying their portfolio, and only trading with money they can afford to lose.

The Impact of Global Events on Trading

Global events, such as elections, economic reports, and geopolitical tensions, can have a significant impact on both Forex and Crypto markets. Traders must stay informed about current events and be prepared to adjust their trading strategies accordingly.

For example, the Brexit vote in 2016 caused significant volatility in the Forex market, while the COVID-19 pandemic has led to increased interest in cryptocurrencies as a potential hedge against inflation.

Future Trends in Forex and Crypto Trading

The Forex market is likely to continue to grow, with new technologies and trading platforms making it more accessible to traders around the world. Meanwhile, the crypto market is still in its infancy and is expected to evolve significantly in the coming years.

One trend to watch is the increasing institutional interest in cryptocurrencies, which could lead to greater regulation and stability in the market. Additionally, advancements in blockchain technology may lead to new use cases for cryptocurrencies beyond just trading.

Forex and Crypto trading offer exciting opportunities for traders, but they also come with their own unique challenges. By understanding the differences between the two markets, educating themselves on trading basics, and having a solid risk management plan in place, traders can increase their chances of success. As the world of trading continues to evolve, staying informed about market trends and global events will be crucial for traders looking to capitalize on the potential of Forex and Crypto markets.