In recent years, the world of trading has been revolutionized by the advent of algorithmic trading. Known as algo trading, this automated approach leverages complex algorithms to execute trades at an unprecedented speed and efficiency. In particular, the realm of Forex and crypto trading has seen a significant uptick in the use of these sophisticated methods. But what exactly is Forex and crypto algo trading, and why is it gaining so much attention?

Defining Forex and Crypto Algo Trading

Forex, or foreign exchange, refers to the global marketplace for trading national currencies against one another. Crypto trading, on the other hand, involves buying and selling digital currencies such as Bitcoin and Ethereum. Algo trading in these markets incorporates the use of computer programs that follow a defined set of instructions for placing trades. The aim is to generate profits at a speed and frequency that is impossible for a human trader.

The algorithms employed in Forex and crypto trading can range from simple to extremely complex. Some may be programmed to follow trends and patterns, while others take into account a wide array of economic indicators and news releases. The algorithms are backtested on historical data before being deployed live to ensure they are effective in real market conditions.

Forex and crypto algo trading can operate 24/7, taking advantage of opportunities that arise outside of regular trading hours. Moreover, since these markets are highly volatile, the use of algorithms can help manage risk and improve trade execution.

The Rise of Algorithmic Trading

Algorithmic trading has become increasingly popular in the financial sector over the past couple of decades. The Forex market was one of the first to adopt these methods, given its complexity and the need for rapid execution of trades. Crypto markets have followed suit, with traders seeking to capitalize on the volatile price movements of digital currencies.

One of the driving factors behind the rise of algo trading is the increase in computing power. Advanced algorithms require significant processing capacity, and recent advances in technology have made this more accessible than ever. Additionally, the growth of machine learning and AI has contributed to the development of more sophisticated trading algorithms.

Another factor contributing to the rise of algo trading is the availability of high-frequency trading (HFT) infrastructure. This allows traders to execute a large number of orders at lightning speed, which is particularly beneficial in Forex and crypto markets where opportunities can come and go in the blink of an eye.

Key Benefits of Algo Trading

Algorithmic trading offers several advantages over traditional manual trading. Firstly, it eliminates human emotion from the equation, which can often lead to poor decision-making. Algo trading follows a set of pre-defined criteria, ensuring consistency and discipline in the execution of trades.

Secondly, algo trading can process a vast amount of data in a fraction of a second. This enables traders to identify and capitalize on market opportunities more efficiently than a human ever could. Finally, the use of algorithms can significantly reduce the cost of trading, as trades are executed automatically without the need for constant monitoring by a trader.

Popular Strategies in Algo Trading

There are numerous strategies employed in the world of algo trading. Some of the most common include:

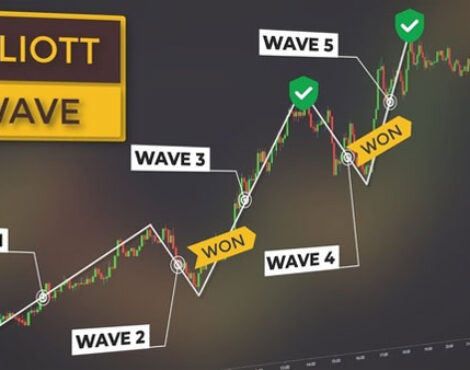

- Trend following, where algorithms are designed to identify and follow market trends.

- Mean reversion, which assumes that prices will revert to their historical average.

- Arbitrage, which exploits price differences between markets or assets.

Each strategy requires a different set of algorithms and comes with its own set of risks and rewards. Traders must carefully evaluate which strategy aligns with their investment goals and risk tolerance.

Risks and Challenges Faced

While algo trading has many benefits, it is not without risks. One of the primary challenges is the potential for technology failures, such as a system crash or a glitch in the algorithm. Similarly, unexpected market events can cause algorithms to behave unpredictably, leading to significant losses.

Another risk is the possibility of overfitting, where an algorithm is too closely tailored to past data and fails to perform in live markets. Additionally, the increasing use of algo trading has led to concerns about market manipulation and the potential for flash crashes, caused by the rapid selling of assets by algorithms.

The Impact of Technology

The evolution of technology has played a pivotal role in the rise of algo trading. Improved computational power has allowed for the creation of more complex algorithms capable of analyzing vast amounts of data in real-time. Advances in AI and machine learning have also contributed to the development of self-learning algorithms that adapt to changing market conditions.

Another technological breakthrough has been the emergence of cloud computing, allowing traders to access powerful computing resources on-demand without the need for significant capital investment. This has democratized algo trading, making it accessible to a broader range of traders.

Choosing the Right Algo Trading Platform

Selecting the right platform is critical for success in algo trading. Traders should consider the following factors:

- Reliability and uptime: The platform should have a proven track record of stability.

- Speed: Execution speed is crucial in markets that move as fast as Forex and crypto.

- Customizability: The ability to tailor algorithms to individual trading strategies is essential.

Additionally, the platform should offer robust backtesting capabilities to evaluate the effectiveness of algorithms before deploying them live.

The Future of Algo Trading in Finance

The future of algo trading in the finance sector looks promising. As technology continues to advance, we can expect even more sophisticated algorithms to emerge, further transforming how trading is conducted.

Furthermore, as more traders recognize the benefits of algo trading, its adoption is likely to increase, leading to greater market efficiency. Finally, regulatory frameworks will continue to evolve to address the challenges posed by algo trading, ensuring a fair and transparent trading environment.

In conclusion, Forex and crypto algo trading represents a significant shift in the world of finance. By leveraging advanced algorithms, traders can execute trades with unparalleled speed and precision, leading to improved profitability. However, as with any trading strategy, there are inherent risks and challenges that must be carefully managed. With the right technology and a solid understanding of the markets, algo trading can offer a competitive edge in the ever-evolving landscape of Forex and crypto trading.