Risk management is an essential aspect of successful trading in both forex and cryptocurrency markets. Traders must carefully assess the risks associated with their investments and implement strategies to mitigate potential losses. This article explores various risk management techniques that traders can use to protect their capital and maximize returns.

Assessing Risks in Forex Trading

Forex trading involves significant risk due to the high volatility of currency markets. Traders must be aware of economic indicators, geopolitical events, and central bank policies that can affect exchange rates. To assess risks in forex trading:

- Analyze currency pairs and their historical performance.

- Monitor global economic reports and news events.

- Understand the impact of interest rate changes on currency values.

- Consider the political stability of countries whose currencies you trade.

- Evaluate the liquidity of the currency pair.

- Pay attention to technical indicators that signal potential market shifts.

Strategies for Crypto Risk Management

Cryptocurrency markets are known for their high volatility and unpredictability, making risk management crucial. To mitigate risks in crypto trading:

- Diversify your crypto portfolio across various assets.

- Set clear profit targets and stick to them.

- Utilize hedging strategies, such as options or futures contracts.

- Keep a close eye on market sentiment and social media trends.

- Stay informed about regulatory updates and their impact on the market.

- Use secure and reputable exchanges to protect your assets.

Diversifying Your Trading Portfolio

A well-diversified trading portfolio is key to managing risk. By spreading investments across different asset classes, traders can reduce the impact of a single asset’s poor performance on their overall portfolio. Consider:

- Including a mix of forex, cryptocurrency, and other assets.

- Allocating proportionately based on risk tolerance and investment goals.

- Continuously rebalancing the portfolio to maintain desired diversification levels.

- Investing in both established and emerging markets.

- Exploring alternative investments such as commodities or real estate.

- Ensuring that no single investment dominates your portfolio.

Understanding Leverage and Margins

Leverage and margins can significantly increase both potential returns and risks. Traders should:

- Use leverage cautiously, as it can amplify losses.

- Ensure they have adequate margin to cover potential losses.

- Understand the terms and conditions of leverage and margin requirements.

- Keep track of their margin usage.

- Avoid over-leveraging their positions.

- Be prepared to adjust leverage levels in response to market conditions.

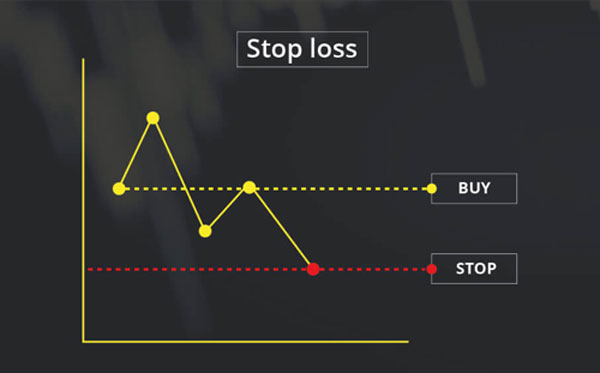

Implementing Stop-Loss Orders

Stop-loss orders are crucial for managing risk and protecting capital. They automatically sell off assets once the price falls below a pre-set level, preventing further losses. Traders should:

- Determine stop-loss levels based on their risk tolerance.

- Place stop-loss orders consistently with every trade.

- Adjust stop-loss orders as the market fluctuates.

- Avoid setting stop-loss levels too close to current market prices.

- Use trailing stop-loss orders to lock in profits.

- Regularly review and modify stop-loss orders as necessary.

Keeping Up with Market Trends

Staying informed about market trends is vital for successful risk management. To keep up with market trends:

- Follow reputable financial news sources and market analysts.

- Analyze market data and charts to spot emerging trends.

- Use technical and fundamental analysis to inform trading decisions.

- Attend webinars, conferences, and other educational events.

- Participate in trading communities and forums.

- Utilize trading tools and software to monitor market movements.

Comparison Table: Forex vs. Crypto Risk Management

| Aspect | Forex Trading | Crypto Trading |

|---|---|---|

| Volatility | High, but more predictable | Extremely high and erratic |

| Market Hours | 24/5 | 24/7 |

| Regulatory Environment | Well-regulated | Varies by region |

| Leverage | Commonly used | Offered by some exchanges |

| Stop-Loss Orders | Essential | Highly recommended |

| Diversification | Important for stability | Crucial for risk reduction |

In conclusion, risk management is a critical component of successful forex and crypto trading. By assessing risks, diversifying their portfolio, understanding leverage and margins, implementing stop-loss orders, and keeping up with market trends, traders can protect their investments and thrive in the volatile world of trading. Effective risk management practices are the foundation of a sustainable and profitable trading career.